Blick, The best CS people are leaving

Erik Wirz in an interview with Blick by Milena Kälin

Headhunters share their experiences with employees of the big bank

Who's leaving CS and who's likely to stay?

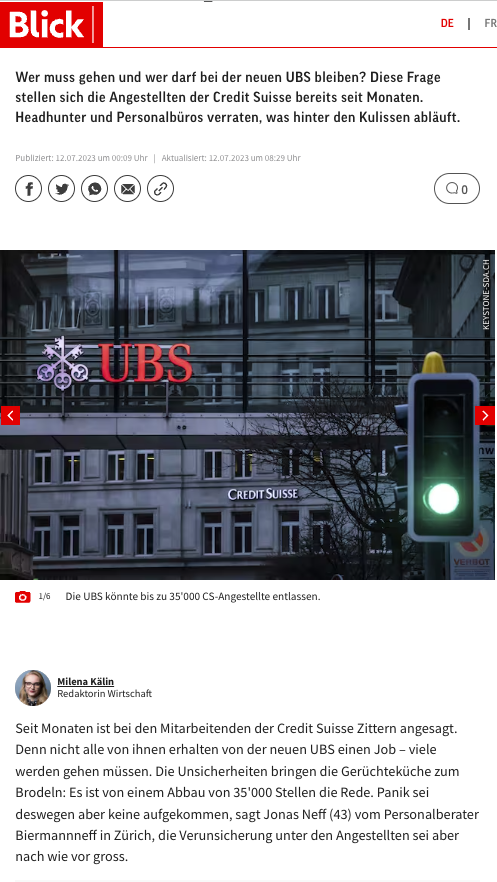

Who has to go and who can stay at the new UBS? Credit Suisse employees have been asking themselves this question for months. Headhunters and human resources departments reveal what is happening behind the scenes.

Credit Suisse employees have been in suspense for months. Not all of them will get jobs with the new UBS - many will have to leave. The uncertainty has fuelled rumours of 35,000 job cuts. Panic hasn't set in yet, but there is still a lot of uncertainty among employees, says Jonas Neff, 43, of the recruitment firm Biermannneff in Zurich.

"Since 19 March, several hundred CS employees have actively contacted us," Neff tells Blick. The recruitment consultant has had many conversations, but many are still cautious. "They are a bit hesitant and want to see the new structures first," says Neff.

The fact that some CS employees will have to pay back part of their bonus if they are made redundant is another reason for their reluctance.

Client base offers opportunities

Neff goes on to explain: "Employees with strong client relationships have a good chance of positioning themselves - regardless of the area. He sees the problem elsewhere: those with the best opportunities are the first to act. "Those who have a harder time are less likely to move," says Neff.

Erik Wirz (54) of Wirz & Partners shares this view. The Swiss headhunter believes that "the people who move are the good ones. UBS won't be happy if they leave".

Wirz specialises in executive positions. According to the headhunter, people with large client portfolios are in high demand.

"International banks, private banks and international asset managers are very active," says Wirz. Women also have an advantage: they have generally been more in demand than men for years.

Back-office redundancies

On the other hand, people in the back office could be in trouble. Once Credit Suisse is fully integrated into UBS, there will be a lot of redundancies.

There is no need for two IT, finance, controlling, operations or HR teams. "It will be a challenge for these people," says Wirz.

Klaus Uhl (53) sees great opportunities, especially for IT or HR professionals. He works for outplacement provider Von Rundstedt. An outplacement provider helps people find a new career. The service is usually paid for by the former employer, unlike in HR departments where the new employer pays for a successful placement. IT or HR professionals have the advantage of being less tied to the banking or financial sector. They are also in demand in other industries, although they may not earn as much, according to headhunter Wirz.

"It will be more difficult for people who work in areas that are present in large numbers at both big banks - such as compliance, marketing and communications, or numerous staff functions," says Uhl. However, he advises Credit Suisse employees not to rush into action. "Everyone should first ask themselves Do I have a clear positioning and can I articulate it convincingly?

But he also warns against remaining passive and hoping for an offer from the merged UBS. Many will have to leave one way or another.